In 2012, Joseph Stiglitz, the 2001 Nobel Laureate, one of the world’s foremost thinkers in contemporary economics, author of the 2012 best-seller titled “The Price of Inequality” was quoted in the New York Times as saying “…..Inequality leads to lower growth and less efficiency. Lack of opportunity means that it’s most valuable asset — its people — is not being fully used.

In 2012, Joseph Stiglitz, the 2001 Nobel Laureate, one of the world’s foremost thinkers in contemporary economics, author of the 2012 best-seller titled “The Price of Inequality” was quoted in the New York Times as saying “…..Inequality leads to lower growth and less efficiency. Lack of opportunity means that it’s most valuable asset — its people — is not being fully used.

Many at the bottom, or even in the middle, are not living up to their potential, because the rich, needing few public services and worried that a strong government might redistribute income, use their political influence to cut taxes and curtail government spending. This leads to underinvestment in infrastructure, education and technology, impeding the engines of growth. . .” He may have been commenting on the state of play in the United States but the words ring true in the context of several economies world-wide including India.

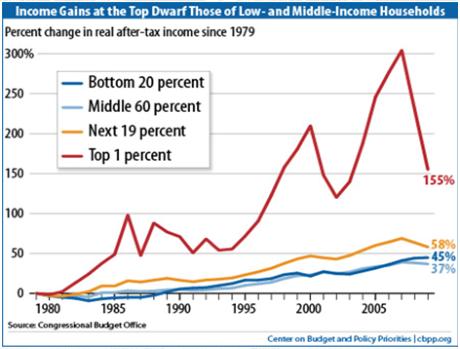

Let’s look at some recently published statistics that highlight the extent of inequality in the Mecca of global Capitalism – the United States. A 2012 US census bureau population report places the average income of the top 2% of American households in 2011 at US $ 0.42 million which is approximately 30 times that of the bottom 30%.In fact, on a purchasing power parity basis, the average household income at the bottom 15% of the US pyramid is lower than the per capita income of Namibia, Algeria or Guyana! An analysis of growth in real post tax income over the last 3 decades since 1979, indicates that at the peak of the financial boom in 2007 (just before the markets collapsed), the top 1% of households in America had grown their incomes 300% while the bottom 20% could only manage a tenth of that growth (see figure: Source – Centre on Budget and Policy Priorities) – possibly underlining the ‘rent-seeking’ behaviour of those with influence. What else could likely explain prolonged periods of favourable tax rates for high income groups and a comfortably high exemption limit estate tax structure that effectively only taxes super-rich couples on estate valued over US $ 10 million after their lifetime?

Much has been written in the US press about the rapidly widening gap between the ‘haves’ and the ‘have-nots’ since the emergence of the global financial crisis. Kenneth Rogoff, professor of economics at Harvard recently commented, rather sombrely, that modern capitalism is in a state of evolution and that while alternatives to modern capitalism do not appear readily available………. ‘Capitalism’s future might not seem so secure in a few decades as it seems now.’

In particular, he identifies key fault lines that capitalism must address to avoid a descent into oblivion: (1) failing to price public goods properly – like clean air, water or a stable climate; (2) inequality; (3) failure to price and provide efficiently for medical care; (4) failing to value the wellbeing of future generations, including through resource depletion; and (5) financial crises.

Considerable talk about increasing the impact of tax on the “super-rich” has already occupied centre-stage – over the last couple of years in the West and more recently in India. Greater need for participation in the fiscal fortunes of their countries, reducing the likelihood of social instability thereby preserving a conducive climate for long term investment and, quite simply, philanthropic motivations have been put forth as arguments for greater tax contribution by the top income groups.

One key driver for the low impact of tax as a percentage of total income for the very rich, especially in the US is due to increased ‘financialisation’ of income streams. In 2010, the Inland Revenue Service (American equivalent of India’s Income Tax Department), estimated that the share of capital gains and equity dividends in total reported income of tax-payers earning more than US $ 10 million was 49% (up from 36% in 2009). These sources of income are taxed at very low or zero rates. As a result, overall contribution by this segment to the tax kitty is significantly muted, leading Warren Buffet to comment last year that his secretary’s effective tax rate was substantially higher than his own.

Since November 2012, reports have periodically surfaced in the Indian media, indicating a re-think by the Government on the peak income tax rates, additional levies for the “very rich” and even, introduction of an estate or inheritance tax. The Union Budget is about three weeks away and therefore, the rhetoric appears to be building up.It appears that some of the current re-think may be attributable to the debate in the West around reducing inequality through increased taxation at the top level. While there can be no question as to the desirability of redistributing incomes in a country like India, we must neither ignore the unintended consequences of such a levy nor forget that the Indian economy is direly in need of productive capital.

India is not the United States and a note of caution is in order. It’s easy to forget that our legal and enforcement systemsare British by design, not by implementation. The likely behavioural consequences of a high top rate of tax are increased efforts at tax evasion, postponement of investment decisions, dummy (benami) holdings, cross-border location of assets / investments and channelling wealth into opaque, non-productive resources such as gold and real estate. There is also interesting research undertaken by the National Bureau Of Economic Research (NBER) in the US context that higher tax rates discourage entrepreneurship and the growth of small firms as entrepreneurs begin to drop productive efforts in view of diminishing returns (due to diminishing marginal benefits). This would indeed be a dismal outcome for a growing economy like India which is desperately in need of entrepreneurship capital and is currently witnessing a stifling shortage of funds to the SME sector.

Instead of levying higher taxes, it may be a better idea to consider incentives that would encourage capital owners to shift resources to productive avenues and unleash capital flow to fund starved sectors. That could alter the growth dynamic in the macroeconomic equation and better help plug the fiscal deficit in the medium term. It goes without saying that all this needs to be balanced with a strong tone and strident execution on enhanced tax enforcement and compliance with existing laws. In about three weeks we will know if better sense has prevailed.