Incidentally, it is important to notice that Greek infrastructure, such as Airports, Ports and Highways are funded by Germany since the Athens Olympics way back in 2004. Another interesting outcome is that, the German Bonds (originally AAA with an annual yield of 4.5% in 2002) suffered a lot (became AAA with 5.2% in 2006).

But even the same Germans are tired now of this unnecessary burden on their shoulders as, Hours before a midnight deadline when Greece will default on a $1.7 billion payment to the International Monetary Fund, German Chancellor Angela Merkel said there will be no new negotiations about Greece’s bailout.

There are certain points that have been found as the primary reasons for this age-old problem in Greece which dates back to days of temple borrowing by the city states. Sparta used to fail pretty regularly those days, as they were predominantly focused on wars and battles.

The primary reason is, as found so far by the researchers is Pension payment. Both amount as well as age till which the Greeks It is found quite astonishing that more than 17.5% of its economic output goes into Pension payments according to Eurostat data of 2012; this pension or social security net is for well-developed countries, where the reserves are not depleting on a steady basis. The Government employee pension schemes are one of the best in the developed world as of now. Even a daughter can claim the pensions of this deceased father.

People in Greece generally work till 67, which is quite high compared to any other EU nations. The current unemployment rate is around 25.6% in Greece in comparison of 9.6% of the entire EU zone, and 4.7% in Germany. Gini Index of Greece has been in a range of 0.345 to 0.3331 in a span of last three decades. So, the income distribution pattern is not alarming also. Greece has struggled to collect taxes from citizens, especially the wealthy, which is a problem when Greece’s national debt is 177 percent of its GDP. Italy’s debt is about 133 percent of its GDP as of 2014, according to Eurostat. Tax evasion has been quite rampant in the Aegean islands.

In fact, most of the buildings in Athens, especially in Plaka are found to be under construction for more than 30 years now. As the house it completed the owner has to start paying taxes immediately on that, so most people do not finish it at all. According to some sources from the analytic world, people believe that if Greece still had the drachma, it could deal with its financial difficulties by devaluing the currency. A cheaper drachma would make Greek goods more attractive to foreigners, boosting exports and creating jobs. Inflation would have helped them to balance their interest rate too.

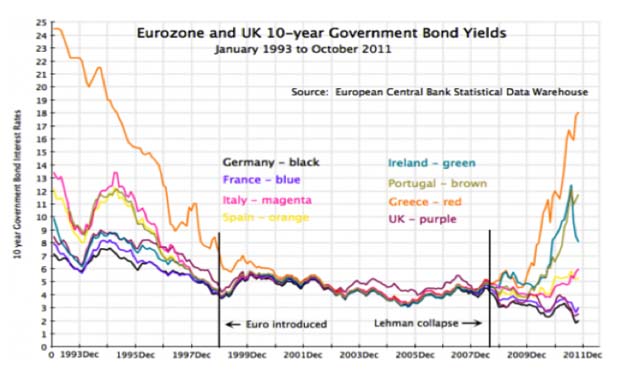

Pre introduction of EURO zone Greece was no match, as its sovereign Bonds were yielding around 24%, where the next closest was Italy with 13%.All the other possible constituents of the EU zone were having it within a range of 7% to 13%. So, from the beginning it was evident that some country has to carry the baggage of Greece in EU. Germany did exactly that for a period of 15 long years. Greek introduction to EU zone was rather political than economic in nature. Current state is such that even a GREXIT will not ease the situation economically neither from the EU side nor from the Greek side. A devalued drachma will be a cause of concern the devaluation of commodity prices will push the inflation suddenly to a high level. Some analysts are even predicting a devaluation of 50% which means the cost of imports would go north sharply, sending inflation to the upper limit.

Politically Greece has also financial, social and cultural ties with Russia. So, Greek exit from EU zone will strengthen the power of depleted Russia from a political angel, as both follow the left-wing way of managing things. Since the general election in January 2015, the left-wing government of this heritage rich country has developed their relationship, visiting President of Russia Vladimir Putin. They in turn signed a deal to open a Greco-Russian natural gas pipeline across Greece in 2016. So the indication were quite clear that the Greek authorities were expecting the exit even six months back and their back up plan will be to have a long term energy based tie with Russia.

With a negative 1.5% monthly growth on country’s Loan base, negative monthly inflation hovering around 1% to 2%,current account deficit of 955 Million EURO, Debt to GDP is 177, industrial production de growth around 20% annually the Aegean giant of yesteryears have a torrid time in front. It seems very much like a long express train with completely different bogies attached one after another. Each bogie is having its own constraints. Some are habituated to go slow and some are trained to go fast at all the time. Since they all are in different pages, so friction and derailing is almost destined to happen.

Google Books , abc news , cnn.com , money.cnn.com , cnyhomepage.com , midlifebreakthrough.com , tradingeconomics.com